Finance Webinar(2023- 02)

Topic : Getting the Banks on Board: Accounts Receivable Financing in the US

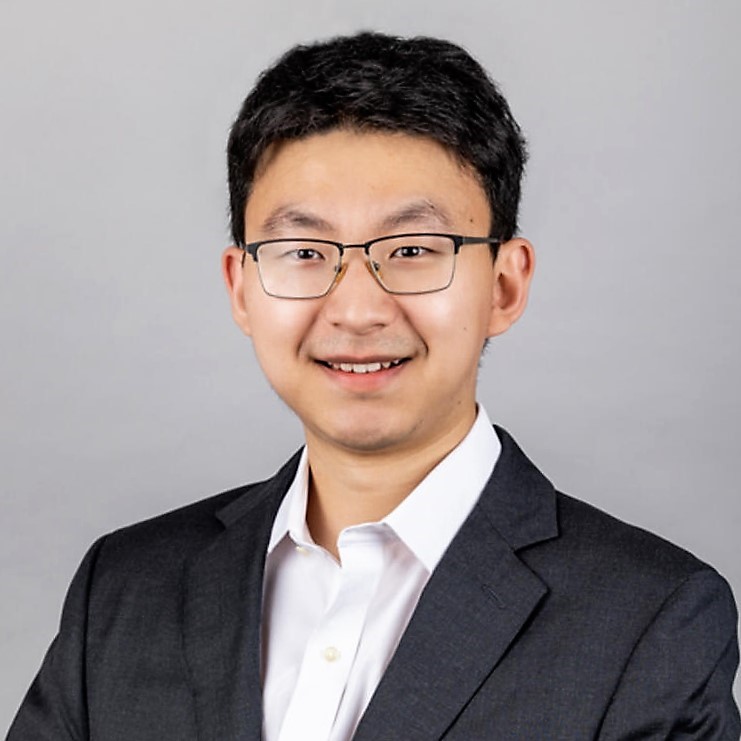

Speaker: Jiaheng Yu, Massachusetts Institute of Technology

Time: Monday, January 9, 10:30 - 12: 00, a.m. Beijing Time

Location: Zoom Online Conference Room

Abstract

This paper studies the informational role of trade credit and the accounts receivable financing market. I hand collect new data on the contracts of accounts receivable based loans and trade credit terms. I find that sellers experiencing payment delays are primarily financed through accounts receivable based loans. These loans are 2-4% per year more expensive than buyers’ borrowing rates and require a 20% average haircut on invoice value. However, lenders help screen out the bad-quality sellers: sellers who successfully receive credit experience a 5% decline in receivable days and have higher sales and longer relationships with buyers. I propose and structurally estimate a trade credit model that incorporates accounts receivable financing. Seller moral hazard that leads to bad-quality products, although difficult to observe in existing data, can be uncovered from terms of accounts receivable financing contracts. In the model, the buyer trades off financial cost and incentive effects of trade credit and learns from the lender’s loan decisions. I show through counterfactual analyses that regulatory limits on payment delays increase the presence of bad products and lower output, while subsidizing accounts receivable financing may increase output at relatively low expense.

Biography

Jiaheng Yu is a PhD Candidate in Finance at the MIT Sloan School of Management. Prior to MIT, he received bachelor’s degrees in Economics and Mathematics from Tsinghua University in 2018. His research interests are: corporate finance, financial markets, financial intermediation and regulation. His recent work studies the interaction of supply chains and the financial market, the design of the Central Bank Digital Currency (CBDC), and dual trading activities in the stock market.

Your participation is warmly welcomed