Finance Seminar(2024 - 04)

Topic: Does the Consolidated Feed Matter?

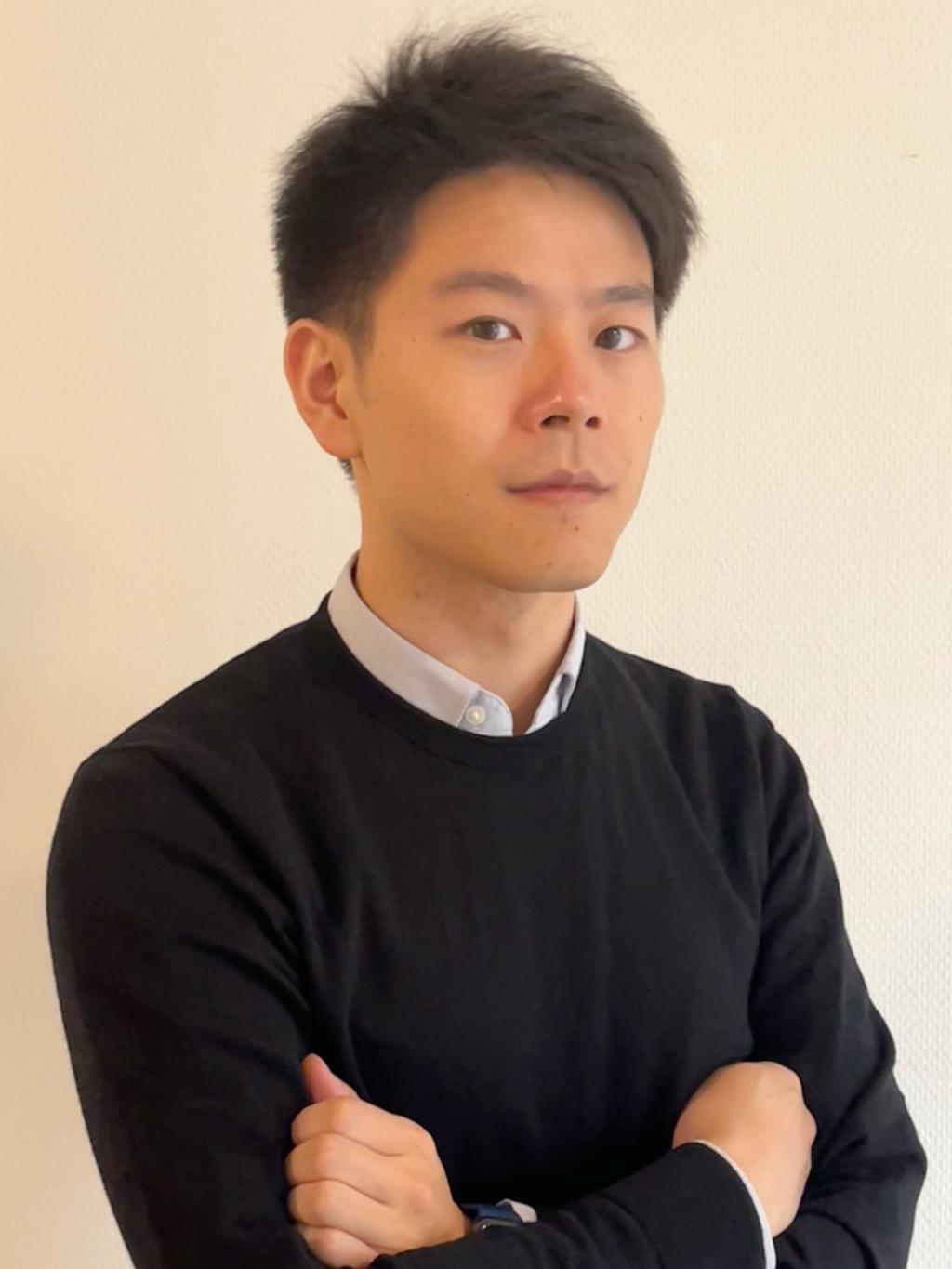

Speaker: Shihao Yu, Columbia University

Time: Monday, January 15, 1:30 – 3:00 p.m. Beijing time

Location: Room 217, Guanghua Building 2

Abstract

We examine the role of the consolidated feed in a fast and fragmented market. Utilizing an exogenous technological shock that significantly reduces the feed’s latency in the US equities market, we find that surprisingly, a faster consolidated feed worsens market liquidity. We show it might stem from informed slow traders benefiting from the speed increase as evidenced by larger price impacts and higher execution efficiency. As a response, high-frequency market makers widen their spreads to compensate for greater adverse selection costs. Additionally, when the consolidated feed is disrupted due to technical glitches, market liquidity significantly worsens. Our findings suggest that the consolidated feed continues to be a crucial component of today’s market data infrastructure, shedding light on market data regulation.

Bio

Shihao Yu is currently a postdoctoral researcher at the Center for Digital Finance and Technologies of Columbia University. Before that, he obtained his PhD from Vrije Universiteit Amsterdam. His research interests include market microstructure, high-frequency trading, and decentralized finance.

Your participation is warmly welcomed!